How do you ensure customers enjoy their online shopping experience?

By using a reliable payment gateway that keeps their information secure and transactions seamless.

As a WooCommerce store owner, picking the right payment gateway is vital. It’s not only about processing payments—it’s about ensuring customers feel safe throughout the experience.

With so many options available, selecting the right one can be challenging.

No worries—we’re here for you!

In this blog, we’ll explore the best WooCommerce payment gateways to help you find the ideal fit for your store.

Also, we’ll include a short comparison table to make your decision easier.

Let’s jump right in!

Understanding WooCommerce Payment Gateways

A WooCommerce payment gateway helps process online payments safely and smoothly on the store itself without leaving the site. It ensures your customers can shop easily while their transactions are handled securely.

It’s just like a connector between your WooCommerce store and the financial accounts you manage. From collecting payment details to different transactions, it makes everything safe and easy.

Here’s a quick overview of how a payment gateway works:

- Step 1: Customer initiates the payment: They pick a product, head to the checkout page, and place their order.

- Step 2: Payment details sent to the gateway: Their details are securely sent to the payment gateway.

- Step 3: Gateway receives the details: It verifies and authorizes the transaction.

- Step 4: Bank finalizes the payment: The gateway communicates with the customer’s bank to finalize the transaction.

- Step 5: Fund transferred to your store: Once approved, the funds are transferred to your store’s account.

- Step 6: A confirmation notification was sent: Both you and the customer are notified of the successful payment.

And that’s it—quick, safe, and hassle-free for you and your customers.

Why Add a Payment Gateway to Your WooCommerce Store?

A reliable payment gateway for your WooCommerce store isn’t just a nice-to-have—it’s a total game-changer. It’s like giving customers a safe, secure environment to complete their purchases.

Think about it: a secure and flexible payment setup isn’t just about processing transactions—it’s about earning your customers’ trust.

And when they trust you, they’re way more likely to click that Purchase Now button without indecision.

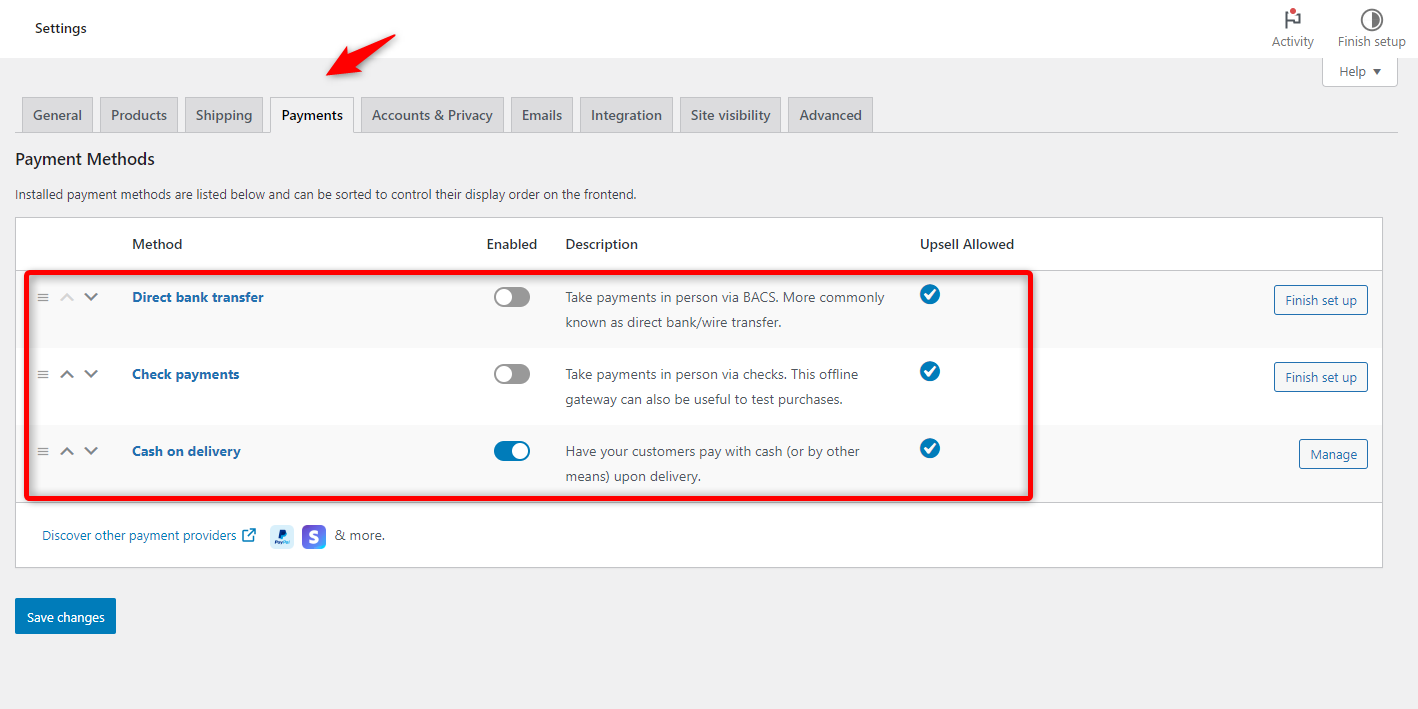

Here’s the catch: WooCommerce’s default payment methods are pretty basic.

You’re limited to bank transfers, cash payments, or cash on delivery. This is not ideal if you want to grow your store and keep your customers happy.

That’s where WooCommerce payment gateways step in to save the day. Here is what they are capable of:

- Instant and secure payment options: No more waiting for transactions to clear.

- Increased payment method variety: Let your customers choose how they want to pay—credit card, digital wallet, or bank transfer.

- Advanced data protection: Encryption keeps their sensitive information safe.

- Faster processing times: Forget the delays of offline payments.

- Easy revenue tracking: Stay on top of your income without sweat.

With the right payment gateway, you’re not just handling transactions—you’re building trust, improving the shopping experience, and making life easier for you and your customers.

10 Best Payment Gateways for Your WooCommerce Store

Here, we have compiled a list of the top payment gateways you can use for your WooCommerce store.

Let’s get started:

1. Stripe

Stripe is one of the most trusted payment gateways for WooCommerce.

It offers various payment options, including credit and debit cards, Apple Pay, Google Pay, Buy Now Pay Later options, local payment methods, and more.

Setting up Stripe with WooCommerce is a breeze. With support for over 135+ currencies, it’s perfect for global stores catering to international customers.

Trusted by giants like Amazon and Shopify, Stripe is known for its reliability and transparency—no hidden fees or unnecessary charges.

Key features of Stripe gateway for WooCommerce:

- It supports all the major credit and debit cards, such as Mastercard, Visa, American Express, Diners Club, and Discover.

- It offers flexible payment options, such as “Buy Now, Pay Later,” Klarna, Affirm, and Afterpay.

- Express checkout options like Apple Pay and Google Pay are available for faster transactions.

- Advanced security measures with SCA (Strong Customer Authentication) and 3D secure

- Local payment support to handle options like SEPA, iDEAL, Bancontact, and Przelewy24 (P24)

Pros of Stripe

- User-friendly interface and easy to set up.

- A variety of payment methods to meet customer preferences.

- PCI-DSS compliant for top-notch security.

- Seamless integration with WooCommerce for a smooth checkout experience.

Cons of Stripe

- Limited customization options for Stripe payment forms.

- Transaction fees can be higher for smaller businesses.

Pricing

- No monthly fees

- 2.9% + $0.30 per successful transaction.

- An additional 1.5% for international payments.

- Higher fees (e.g., 5.99% + $0.30) for services like Klarna.

✅ It’s perfect for WooCommerce store owners looking for a straightforward and secure way to accept online payments in various payment methods.

WooCommerce doesn’t include Stripe by default, but FunnelKit Pay makes the integration effortless. It allows you to connect Stripe to your WooCommerce store quickly and offer a seamless payment experience for your customers.

Packed with advanced features, FunnelKit Pay is the ultimate tool to elevate your store’s checkout process.

2. Square

Square is another popular payment gateway, especially for small and medium-sized businesses. People love to have it in their store because it’s simple, transparent, and super easy to set up.

Whether you run an online store or handle in-person sales, Square offers online payment processing and a free POS system.

Plus, it integrates seamlessly with WooCommerce, making it a no-brainer for store owners looking for a hassle-free solution.

Key features of Square

- Supports both in-person and online payments

- Automatic sync with Square devices for smooth operations

- Built-in tools for coupons, invoices, and appointment scheduling

- Inventory management and invoicing included

- PCI compliance with end-to-end encryption for top-notch security

Pros of Square

- No monthly fees—pay only for what you use

- Supports delivery and in-store pickup options

- Access to real-time reports for better decision-making

- It comes with a free POS system for physical stores

- Quick and simple to set up

- Transparent pricing with no hidden costs

Cons of Square

- Limited to specific countries (US, Canada, Australia, Japan, UK)

- Customer support can be slow during busy periods

- Chargeback disputes can take longer to resolve

Pricing

- In-person payments: 2.6% + $0.10 per transaction

- Online payments: 2.9% + $0.30 per transaction

- Manually entered payments: 3.5% + $0.15 per transaction

- No monthly fees

- Custom pricing available for high-volume businesses

✅ Square is perfect for small businesses, entrepreneurs, and anyone with a physical store or pop-up shop.

3. Mollie Payments for WooCommerce

Mollie is a versatile payment gateway designed for businesses of all sizes. It offers simplicity, transparency, and seamless integration with WooCommerce.

Whether targeting local customers or managing a global e-commerce operation, Mollie supports various payment methods to help you connect with more buyers.

Its user-friendly setup and flexible payment options make it a favorite among WooCommerce store owners looking for hassle-free payment management.

Key features of Mollie

- Supports local and international payment methods, including iDEAL, SEPA, PayPal, and credit/debit cards

- Built-in recurring payment support for subscriptions

- Multi-currency support for global transactions

- Hosted payment pages for secure processing

- Real-time dashboard for tracking payments and insights

- PCI DSS compliant for maximum security

Pros of Mollie

- No setup or hidden monthly fees—pay per transaction

- Easy integration with WooCommerce and other platforms

- Wide range of payment methods to cater to diverse audiences

- Robust fraud detection and security features

- Flexible options for recurring payments and subscriptions

Cons of Mollie

- Limited customer support options compared to competitors

- Fees can add up for smaller businesses with high transaction volumes

- Not available in many countries

Pricing

- Per transaction: Varies by payment method (e.g., credit card payments start at 1.8% + €0.25)

- No monthly or setup fees

- Additional charges may apply for currency conversions and certain services

✅ Mollie is an excellent fit for businesses targeting international markets, offering flexibility with local payment options and subscription support.

4. Razorpay for WooCommerce

Razorpay is a leading payment gateway for businesses of all sizes. It offers a seamless payment experience and supports various local and international payment methods.

Known for its versatility and robust features, Razorpay is a go-to solution for businesses targeting Indian customers and beyond.

Its smooth integration with WooCommerce makes it an excellent choice for store owners looking for a reliable and feature-packed payment gateway.

Key features of Razorpay

- Supports 100+ payment modes, including UPI, net banking, credit/debit cards, and wallets

- Built-in subscription and recurring payment support

- Advanced fraud detection and 24/7 monitoring

- Instant refunds and payment settlement options

- Developer-friendly APIs for easy customization

- PCI DSS Level 1 compliant for maximum security

Pros of Razorpay

- Easy WooCommerce integration with a user-friendly setup process

- Accepts both domestic and international payments

- Real-time tracking and analytics dashboard

- No upfront setup fees

- Supports UPI and other India-specific payment methods

- Offers RazorpayX for payroll and vendor payouts

Cons of Razorpay

- Primarily focused on Indian businesses, with limited global availability

- Customer support can be slow for complex queries

- Higher transaction fees for international payments

Pricing

- Domestic transactions: 2% per transaction

- International transactions: 3% per transaction

- No setup or maintenance fees

- Additional charges may apply for premium services

✅ Razorpay is ideal for businesses operating in India or targeting Indian customers. Its support for UPI, net banking, and wallets, along with global payment options, provides flexibility and security to meet diverse business needs.

5. Paypal

PayPal ranks as one of the most recognized and trusted payment gateways worldwide. Its easy use and widespread acceptance make it a go-to option for businesses and customers.

Integrating PayPal into your WooCommerce store enables customers to pay using their PayPal balance, linked bank accounts, or credit/debit cards.

It’s a great way to appeal to a broad audience, especially those who prefer the convenience of PayPal for online purchases.

Key features of PayPal

- Quick fund transfers to your account

- Professional invoicing tools for easy billing

- Flexible API integration for customization

- In-person payments via PayPal terminals

- Secure bank account linking for transfers

- Encrypted checkout for customer data protection

- Financing options through PayPal Credit

Pros of PayPal

- Advanced security features, including fraud detection

- Simple setup and easy for customers to use

- Supports various payment methods, from PayPal balances to credit/debit cards

Cons of PayPal

- Dispute resolution often leans in favor of buyers

- Limited options for customizing the checkout experience

Pricing

- Per transaction: 2.9% + $0.30

- International transactions: Additional 1.5% fee

- Other charges may apply based on specific services used

✅ PayPal is a great option for WooCommerce stores that want to offer a trusted and widely recognized payment method.

6. Braintree for WooCommerce Payment Gateway

WooCommerce PayPal Powered by Braintree is a robust payment solution that combines PayPal’s convenience with Braintree’s versatility.

It allows businesses to accept various payment methods, including PayPal, credit and debit cards, and even digital wallets, all through a single WooCommerce plugin.

With seamless integration, advanced security measures, and support for recurring payments, it’s an excellent choice for store owners who want a comprehensive payment gateway.

Key features of WooCommerce PayPal powered by Braintree

- Supports PayPal, credit/debit cards, and digital wallets like Google Pay and Apple Pay

- Advanced fraud protection tools to secure transactions

- Built-in support for recurring payments and subscriptions

- PCI compliance for enhanced data security

- Supports multi-currency transactions for global businesses

Pros of Braintree for WooCommerce

- Seamless integration with WooCommerce for easy setup

- No additional fees for refunds processed through PayPal

- Accepts a wide range of payment methods, including digital wallets

- Transparent pricing with no hidden charges

- Suitable for both small businesses and large-scale operations

Cons of Braintree for WooCommerce

- Requires a PayPal Business account for setup

- Limited customization options for checkout forms

- International transaction fees can be higher for some businesses

Pricing

- No setup fees or monthly charges

- Transaction fees: 2.9% + $0.30 per transaction (may vary by region)

- Additional fees for international transactions and currency conversion

✅ WooCommerce PayPal Powered by Braintree is ideal for businesses seeking a flexible, secure, easy-to-use payment gateway.

7. Amazon Pay

Amazon Pay lets customers use their existing Amazon account to shop on your WooCommerce store.

Familiarity with Amazon’s platform builds trust and can significantly boost your conversion rates, especially among customers who shop regularly on Amazon.

Amazon Pay is an excellent addition to any WooCommerce store with its streamlined checkout process and robust security.

Key features of Amazon Pay

- Seamless integration with the Amazon ecosystem

- Secure storage of payment details for faster transactions

- Multi-currency support for global businesses

- Suitable for nonprofits, small stores, and large enterprises alike

Pros of Amazon Pay

- Leverages Amazon’s reputation to enhance customer trust

- Simplifies checkout with saved Amazon payment details

- Free setup with top-tier security features

- Mobile-friendly for on-the-go shoppers

- Easily accept Amazon payments on your WooCommerce site

- Customizable buttons and widgets for a tailored look

Cons of Amazon Pay

- Only accessible to customers with Amazon accounts

- Higher fees for international payments

- Does not support recurring billing, limiting options for subscription-based services

Pricing

- No setup, monthly, or annual fees

- Refunds are free, but the $0.30 authorization fee is non-refundable

- Additional fees may apply for international transactions

✅ Amazon Pay is an excellent option for e-commerce stores looking to provide a smooth, reliable, and trusted checkout experience.

8. Apple Pay

Apple Pay is a fast, secure, and easy-to-use payment solution designed for Apple device users. With its focus on seamless integration and advanced security, Apple Pay is an excellent choice for businesses looking to cater to tech-savvy customers.

Its smooth compatibility with WooCommerce allows you to provide a top-tier checkout experience for your store.

Key features of Apple Pay

- One-touch payments with Face ID or Touch ID for fast checkouts

- Tokenization technology for enhanced security

- Compatible with iPhone, iPad, Apple Watch, and Mac

- No additional app required—integrates directly into Apple devices

- Supports credit/debit cards and digital wallets linked to Apple Pay

Pros of Apple Pay

- Incredibly secure with encryption and tokenization for all transactions

- Simplifies checkout with one-touch payments

- No additional fees for using Apple Pay

- Fully optimized for mobile and desktop platforms

- Enhances trust and convenience for Apple device users

Cons of Apple Pay

- Limited to Apple device users, reducing accessibility for Android users

- Availability depends on the country and participating banks

- Not ideal for businesses with a non-Apple customer base

Pricing

- No additional costs to use Apple Pay—standard transaction fees apply from your payment gateway provider (e.g., Stripe or PayPal).

✅ Apple Pay is ideal for businesses targeting Apple users who value convenience, speed, and security.

9. Alipay

Alipay is another popular payment gateway in the market, especially in China. It handles billions of transactions every year, is a trusted option for customers, and is a must-have for businesses looking to tap into the Chinese market.

With support for 27 currencies and operations in over 110 countries, Alipay brings global reach with a focus on reliability and security, making it a great choice for WooCommerce stores.

Key features of Alipay

- QR code payments for quick and easy transactions

- Scan-to-bind functionality for seamless account linking

- User-demand mode payments for personalized experiences

- Accepts payments via Alipay accounts and credit/debit cards

- Escrow system to ensure secure and legitimate transactions

Pros of Alipay

- Simple integration with WooCommerce

- Secure mobile payments supported

- Direct payment options from Alipay accounts

- Effective management of recurring payments

Cons of Alipay

- Primarily caters to Chinese consumers, limiting reach outside the region

- Higher fees for businesses operating outside China

- Reduced functionality for non-Chinese markets

Pricing

- Standard fee: 3% per transaction (may vary by processor or transaction type)

- Additional fees for currency conversion or international transactions may apply.

✅ Businesses looking to target Chinese consumers and provide them with a familiar, secure, and trusted payment option.

10. WooCommerce Payments

WooCommerce Payments is WooCommerce’s payment solution, crafted to work seamlessly with its platform.

Designed with simplicity, it lets you handle payments, refunds, and chargebacks right from your WooCommerce dashboard.

It supports all major credit and debit cards and gives you clear insights into your transactions—making it a smart choice for store owners who want everything in one place.

Key features of WooCommerce Payments

- Easy-to-install WooCommerce plugin for quick setup

- Accept payments from credit/debit cards and Alipay directly

- Strong security measures to protect transactions and customer data

- Built-in tools for recurring payment management

- PCI-compliant for secure payment processing

Pros of WooCommerce Payments

- Seamless integration with WooCommerce

- Zero setup fees—just plug and play

- Manage payments, refunds, and disputes from one dashboard

- Supports multiple payment methods for flexibility

- Handles high transaction volumes without hiccups

- Detailed transaction reports to track sales and revenue

Cons of WooCommerce Payments

- Only available in certain countries like the US, Canada, and parts of Europe

- Lacks advanced customization features for payment forms

- Support can be slow for more complex issues

Pricing

- No monthly fees, but they charge for international payments, currency conversions, and disputes.

- Transaction fees vary by country, so checking their fee structure for specifics is best.

✅ WooCommerce Payments is a great choice for small to medium-sized e-commerce stores looking for a straightforward, easy-to-use payment solution that integrates perfectly with their WooCommerce setup.

How to Choose the Best Payment Gateway for Your WooCommerce Store?

Choosing the right payment gateway for your WooCommerce store is important. With so many options, it might seem overwhelming. However, focusing on the right factors can make it simple.

Here are some things to consider when choosing the best payment gateway:

1. Security

Online shoppers care about one thing: the safety of their data. And you should, too. Look for a payment gateway that offers strong fraud protection and follows PCI-DSS standards.

This will ensure that both you and your customers feel secure and safe.

2. Price

Let’s face it—fees can add up fast. Ensure the gateway fits your budget, whether setup fees, monthly charges, or per-transaction costs.

The key is to find a balance—affordable pricing without skimping on the features you need.

3. Checkout experience

A smooth checkout experience is key to avoiding cart abandonment. Your payment gateway should offer multiple options, be mobile-friendly, and simplify the process for all customers.

A simple, intuitive checkout ensures even first-time visitors can complete their purchase without hassle.

FunnelKit Funnel Builder is a great tool to enhance the shopping experience. It lets you create global checkout pages, add upsells, and recover abandoned carts, all of which help boost sales and improve the overall shopping experience.

4. Payment options

No one loves waiting! Yes, customers love the flexibility.

Your gateway should support a variety of payment methods, including credit cards, digital wallets, local payment methods, and Buy Now, Pay Later options.

The more choices you offer, the less likely customers will bail on their purchase.

5. Transaction speed

Nobody likes waiting. Choose a payment gateway that processes transactions quickly so customers aren’t stuck twiddling their thumbs after hitting “pay.”

Fast payments mean happy customers and smoother operations on your end.

6. Customer support

Let’s be honest—things go wrong sometimes. And when they do, you want a gateway with responsive and reliable customer support. Quick help via live chat, email, or phone can save you hours of frustration and keep your store running smoothly.

You should know These basic things before using a payment gateway for your WooCommerce store.

A Comparison Table of The Best Payment Gateway for WooCommerce

Here’s a quick comparison of the best WooCommerce payment gateways to help you decide which one is the best fit for your business:

| Payment Gateways | Key features | Pricing | Available countries | Currency Support | Express checkout | BNPL support | PCI compliance |

| Stripe | Wide range of payment options, Advanced security, Local payment support | 2.9% + $0.30, 1.5% for international | 40+ countries | 135+ currencies | Apple Pay, Google Pay | Klarna, Afterpay, Affirm | Yes |

| Square | POS system, Inventory management, Sync with devices | 2.6% in-person, 2.9% online, No monthly fees | US, Canada, UK, Australia, Japan | Major currencies | Apple Pay, Google Pay | No | Yes |

| Mollie | Supports local & international methods, Recurring payments | Varies (e.g., 1.8% + €0.25 for cards), No monthly fees | Available in most countries | Multi-currency support | No | No | Yes |

| Razorpay | 100+ payment modes, Subscription support, Developer-friendly APIs | 2% domestic, 3% international, No setup fees | India-focused, Limited global reach | Indian Rupees + Global currencies | No | No | Yes |

| PayPal | PayPal Credit, Professional invoicing, Flexible API integration | 2.9% + $0.30, 1.5% for international | 200+ countries | 25+ currencies | PayPal Express Checkout | Yes | Yes |

| Braintree | Card vaulting, Fraud prevention, Multi-currency support | Depending on the gateway provider, Competitive rates | Global | Major currencies | Depends on provider | Depends on provider | Yes |

| Google Pay | Tokenization, Loyalty card support, One-tap payments | No additional fees; Gateway provider fees apply | Global (focused on Android users) | Major currencies | Yes | No | Yes |

| Apple Pay | Tokenization, Face/Touch ID, Multi-device support | Same | Global (focused on Apple users) | Major currencies | Yes | Yes | Yes |

| Alipay | QR codes, Escrow payments, Seamless account linking | 3% per transaction, Currency conversion fees | 110+ countries (China-focused) | 27 currencies | No | No | Yes |

| WooCommerce Payment | WooCommerce integration, Recurring payments, Dashboard management | Varies by country, Charges for international & disputes | US, Canada, Europe | Multiple currencies | Apple Pay, Google Pay | No | Yes |

Winner: Stripe

Stripe is the best WooCommerce payment gateway. It supports Apple Pay, Google Pay, local gateways like iDEAL, Bancontact, SEPA, P24, and BNPL options like Afterpay, Affirm, and Klarna, offering unmatched flexibility.

Robust security features like SCA and 3D Secure and multi-currency support make it a reliable global choice.

Integrating Stripe with WooCommerce is simple. Its seamless setup and intuitive interface make it ideal for store owners who want quick, hassle-free payments.

With FunnelKit Pay, you can make the integration even easier. It streamlines the setup and improves your checkout process, which can help increase conversions.

For a secure, flexible, and easy-to-use payment gateway, Stripe with FunnelKit is the perfect choice! 👍

WooCommerce Payment Gateway FAQs

1. What is the best payment gateway for WooCommerce?

The best payment gateway depends on your needs. Stripe is a top choice for its global reach, multi-currency support, and flexible options like Buy Now Pay Later. If you’re targeting specific regions, options like Alipay (China) or PayPal may be better.

2. Are WooCommerce payment gateways accessible?

Some payment gateways, like WooCommerce Payments and PayPal, have no setup fees but charge transaction fees. Others, like Stripe, are free to set up but come with per-transaction charges. Be sure to compare pricing structures before choosing.

3. How do I set up a payment gateway in WooCommerce?

To set up a payment gateway:

- Go to WooCommerce > Settings > Payments in your dashboard.

- Select your desired gateway and click Set Up.

- Enter the required details, such as API keys or account credentials.

- Save changes and test the setup to ensure it works correctly.

If you’re using Stripe, FunnelKit Pay can simplify the integration process for a hassle-free setup.

4. Are WooCommerce Payments better than Stripe?

WooCommerce Payments is excellent for simplicity and direct integration with WooCommerce.

However, Stripe offers more advanced features, such as support for multiple currencies, local payment methods, and Buy Now Pay Later services. It is ideal for stores with international customers or specific payment needs.

5. Why is it important to choose the right WooCommerce payment gateway?

The exemplary gateway ensures secure, smooth transactions, boosts customer trust and reduces cart abandonment. Choosing one tailored to your audience’s preferences and business needs can directly impact your sales and customer satisfaction.

Wrapping Up

We’ve reviewed the best WooCommerce payment gateways, breaking down their features, pros, and cons.

After weighing the options, Stripe wins the competition. Its flexibility, support for global payments, and competitive pricing make it a go-to choice for businesses of all sizes.

Are you already using Stripe? Awesome! If not, it’s worth using it to power your WooCommerce checkout with reliability and ease.

Check out FunnelKit Pay to make integration seamless and hassle-free. It simplifies connecting Stripe with your WooCommerce store, ensuring a smooth and efficient checkout experience.

Take your payment game to the next level with Stripe and FunnelKit Pay—a winning combination for growing your store! 🚀